The scorecard is constructed using our hybrid GAM-Decision Tree model. This process begins with calculating the GAM score based on IMP_CLAGE, IMP_DEROG, and IMP_DELINQ (CLAGE, DEROG and DELINQ after imputation). The GAM score calculation starts at 0 and is adjusted as follows:

| Variable | Condition | GAM Adjustment |

|---|---|---|

| IMP_DELINQ | IMP_DELINQ = 0 |

GAM = GAM + 2.57066154046 |

IMP_DELINQ = 1 |

GAM = GAM + 2.08231470274 |

|

IMP_DELINQ = 2 |

GAM = GAM + 1.32067935856 |

|

IMP_DELINQ = 3 |

GAM = GAM + 1.12671971708 |

|

IMP_DELINQ = 4 |

GAM = GAM + 1.06024767261 |

|

IMP_DELINQ = 5 |

GAM = GAM - 0.187270502707 |

|

IMP_DELINQ = 6 |

GAM = GAM - 1.16612086452 |

|

IMP_DELINQ = 7 |

GAM = GAM - 1.12016683131 |

|

IMP_DELINQ = 8 |

GAM = GAM - 0.815202415445 |

|

IMP_DELINQ = 10 |

GAM = GAM - 1.29377825181 |

|

IMP_DELINQ = 11 |

GAM = GAM - 1.27805891547 |

|

| IMP_DEROG | IMP_DEROG = 0 |

GAM = GAM + 2.56838053911 |

IMP_DEROG = 1 |

GAM = GAM + 1.88487325753 |

|

IMP_DEROG = 2 |

GAM = GAM + 1.36118958569 |

|

IMP_DEROG = 3 |

GAM = GAM + 0.736978317416 |

|

IMP_DEROG = 4 |

GAM = GAM - 0.552113120056 |

|

IMP_DEROG = 5 |

GAM = GAM + 2.56128811571 |

|

IMP_DEROG = 6 |

GAM = GAM + 1.31328913024 |

|

IMP_DEROG = 7 |

GAM = GAM + 0.607532683746 |

|

IMP_DEROG = 8 |

GAM = GAM - 0.970189363149 |

|

IMP_DEROG = 9 |

GAM = GAM - 0.219770719014 |

|

| IMP_CLAGE | IMP_CLAGE <= 200 |

GAM = GAM - 0.75 |

200 < IMP_CLAGE <= 600 |

GAM = GAM + 0.5 |

|

600 < IMP_CLAGE <= 1000 |

GAM = GAM + 1 |

|

IMP_CLAGE > 1000 |

GAM = GAM - 0.5 |

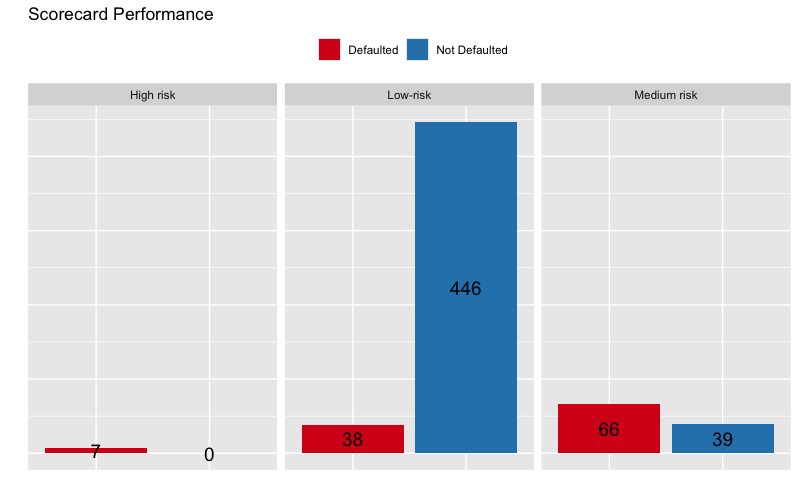

After obtaining the GAM score, we classify applicants into risk groups based on their DEBTINC and GAM values.

The final risk classification is as follows:

| DEBTINC Condition | GAM Condition | Risk level Classification |

|---|---|---|

Missing or DEBTINC >= 45 |

GAM < 1.7 |

“High risk” |

Missing or DEBTINC >= 45 |

1.7 <= GAM < 5.5 |

“Medium risk” |

Missing or DEBTINC >= 45 |

GAM >= 5.5 |

“Low-risk” |

DEBTINC < 45 |

GAM < 1.7 |

“High risk” |

DEBTINC < 45 |

1.7 <= GAM < 2.5 |

“Medium risk” |

DEBTINC < 45 |

GAM >= 2.5 |

“Low-risk” |